Printing W-2 forms is one of the most important payroll tasks every business must complete at the end of the year. Whether you are using QuickBooks Desktop or QuickBooks Online, knowing the correct process can save time, prevent errors, and help you stay IRS-compliant. Many users struggle with issues like missing W-2 forms, blank W-2 forms, incorrect information, or reprinting a lost W-2, especially during tax season.

This detailed guide explains how to print W-2 forms in QuickBooks Desktop and QuickBooks Online, how to fix errors, how to find old W-2s, and how employees can access their W-2 forms online. If you need immediate assistance at any step, you can call 844-753-8012 for QuickBooks W-2 printing support.

Also Read: How to Fix QuickBooks Payroll Items on Paycheck Are Not Calculating Issue?

Understanding QuickBooks W-2 Forms

A W-2 form reports an employee’s annual wages and the taxes withheld by the employer. Employers are legally required to:

- Provide W-2 forms to employees

- File W-2 forms with the IRS and Social Security Administration

QuickBooks simplifies this process by automatically generating W-2 forms using your payroll data. However, the printing steps vary slightly between QuickBooks Desktop and QuickBooks Online, and issues may arise if payroll setup is incomplete.

How to Print W-2 Forms in QuickBooks Desktop

QuickBooks Desktop users can print W-2 forms directly from the Payroll Center. Before printing, ensure your payroll subscription is active and payroll updates are installed.

Step-by-Step: QuickBooks Desktop W-2 Printing

- Open QuickBooks Desktop

- Go to Employees from the top menu

- Select Payroll Tax Forms & W-2s

- Click Process Payroll Forms

- Choose Annual Form W-2/W-3 – Wage and Tax Statement

- Select the correct tax year

- Choose employees (all or selected)

- Click Open/Save Selected

- Review the form and select Print

Printing Tips for Desktop Users

- Use black ink only

- Use IRS-approved perforated W-2 paper

- Always preview the form before printing

This process supports quickbooks W-2 printing for both employee copies and employer records.

How to Print W-2 Forms in QuickBooks Online

QuickBooks Online allows employers to print W-2 forms directly from the Payroll Tax section. Depending on your payroll plan, you can print employee copies or view filed forms.

Step-by-Step: QuickBooks Online W-2 Printing

- Sign in as an admin

- Go to Taxes from the left menu

- Select Payroll Tax

- Click Filings & Forms

- Open Annual Forms

- Choose W-2s and select the year

- Click View or Print

QuickBooks Online W-2 printing usually allows you to print Copies B, C, and 2 for employees. Copy A is typically e-filed with the government.

Also Read: QuickBooks Online Connection Issues: Causes, Fixes, and Expert Help

QuickBooks W-2 for Employees: How Employees Can Access W-2 Forms

Employees often ask, “How do I find my W-2 form online?” If you use QuickBooks Workforce, employees can securely access their W-2s.

Employee Steps:

- Log in to QuickBooks Workforce

- Click Tax Forms

- Select the year

- Download or print the W-2

This reduces requests for reprints and ensures quick access to tax documents.

How to Reprint a Lost W-2 Form on QuickBooks

If an employee loses their W-2 or never received it, you can easily reprint it.

Reprint W-2 in QuickBooks Desktop

- Follow the same steps as printing

- Choose the correct year and employee

- Print again

Reprint W-2 in QuickBooks Online

- Go to Payroll Tax > Annual Forms

- Select W-2 and year

- Print a duplicate copy

Always label reprinted forms as “Reissued Statement” if required.

How to Find Old W-2 Forms in QuickBooks

Many users need to find old W-2 forms for previous years.

- In QuickBooks Desktop, choose the prior tax year when processing payroll forms

- In QuickBooks Online, use the year filter under Annual Forms

QuickBooks stores W-2 data for multiple years, making it easy to retrieve historical records.

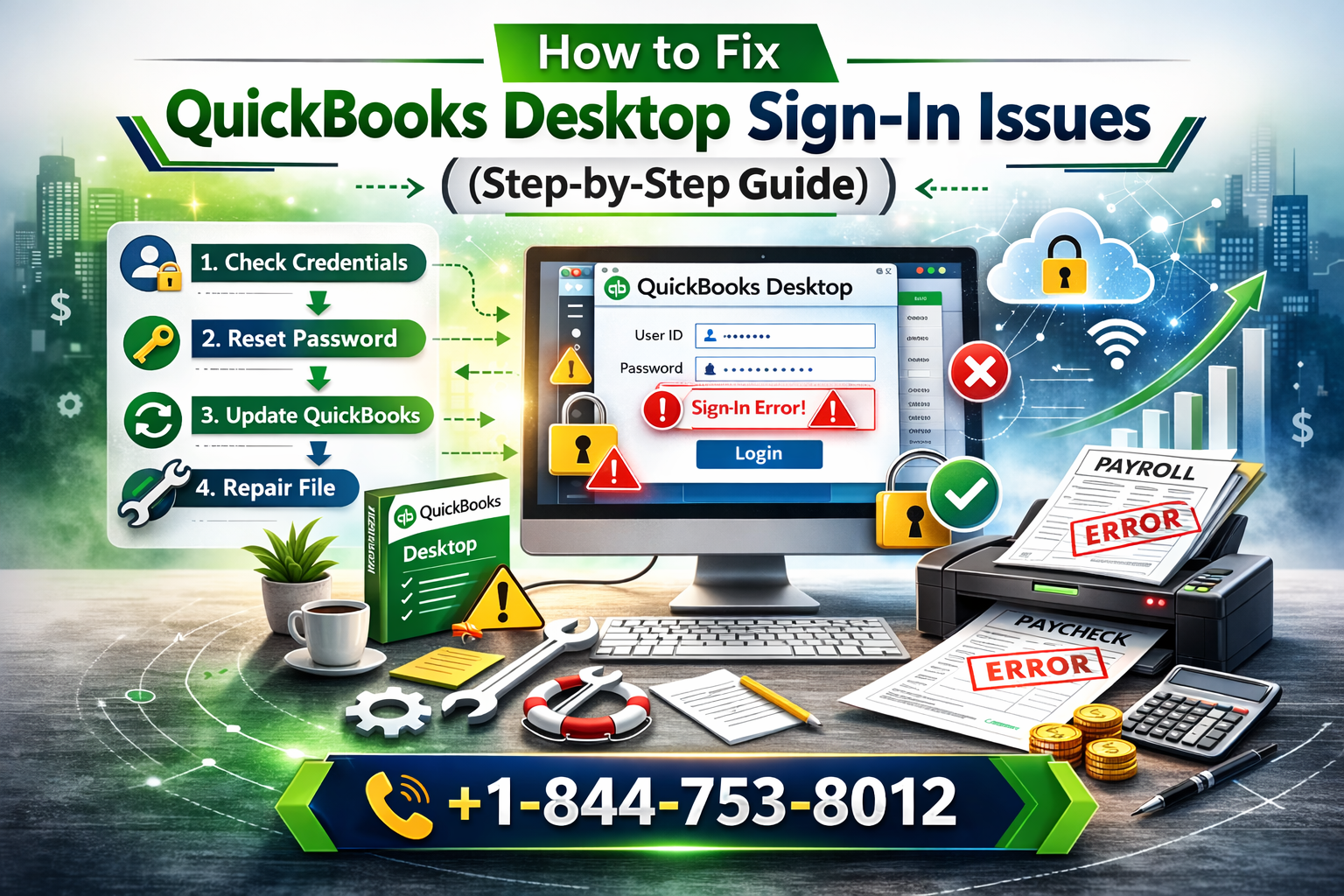

Fix an Incorrect W-2 in QuickBooks

Errors happen. You might notice incorrect wages, taxes, or employee details on a W-2.

If the W-2 Has NOT Been Filed

- Correct the employee or payroll information

- Recreate and reprint the W-2

Filed Incorrect W-2 Form in QuickBooks

If the W-2 has already been filed with the IRS, you must file a W-2c (Corrected W-2).

How to Correct a W-2 in QuickBooks Online and Desktop

QuickBooks Desktop:

- Go to Employees > Payroll Center

- Select File Forms

- Choose W-2c/W-3c

- Enter corrected information

- Print and file the corrected form

QuickBooks Online:

Some corrections require assistance from QuickBooks Payroll Support, especially if QuickBooks filed the forms on your behalf. Call 844-753-8012 for help correcting a filed W-2.

Common W-2 Problems and Solutions

Blank W-2 Form

A blank W-2 form usually means:

- Payroll was not set up correctly

- You selected the wrong form copy

- Payroll taxes were not calculated

Review payroll settings and reprint the form.

Missing W-2 Form

If a missing W-2 form occurs:

- Confirm the employee was paid during the year

- Check Workforce delivery settings

- Reprint the W-2 manually

W-2 Form Appears Blank When E-Filing – QuickBooks

This issue may occur due to:

- Browser cache issues

- Incorrect form selection

- Unsupported PDF viewer

Try downloading the form and opening it with Adobe Reader.

Filling Out W-2 Form in QuickBooks

You do not need to manually enter data into a blank W-2 form. QuickBooks automatically fills out W-2 forms based on:

- Payroll wages

- Tax withholdings

- Employee information

Always verify employee names, Social Security numbers, and addresses before printing.

Find My W-2 Form Online: Employer and Employee Tips

- Employers can find W-2s under Payroll Tax Forms

- Employees can find W-2s through QuickBooks Workforce

- Former employees may need employer assistance for access

Best Practices for QuickBooks W-2 Printing

- Review payroll reports before printing

- Print a test copy

- Use correct paper type

- Store digital copies securely

- Reprint early to avoid last-minute issues

When to Contact QuickBooks W-2 Support

If you experience:

- Filing errors

- Correction issues

- Missing or incorrect W-2s

- Printing problems

You can contact QuickBooks W-2 experts at 844-753-8012 for immediate help.

Final Thoughts

Knowing how to print W-2 forms in QuickBooks Desktop and QuickBooks Online is essential for every business owner and payroll manager. From printing and reprinting to correcting mistakes and finding old W-2s, QuickBooks provides powerful tools when used correctly.

If you need professional guidance, error resolution, or step-by-step assistance, don’t hesitate to call 844-753-8012 and get expert QuickBooks payroll support today.