Filing W-2 forms accurately is crucial for both compliance and employee satisfaction. However, sometimes QuickBooks Desktop users accidentally file duplicate W-2 forms electronically, which can cause confusion with the IRS and Social Security Administration. If you’re wondering how to fix this issue, you’re not alone.

In this guide, we’ll walk through how to correct duplicate W-2 forms in QuickBooks Desktop, why this happens, and preventive measures to avoid future mistakes.

Why Duplicate W-2s Happen in QuickBooks Desktop

Duplicate W-2s are usually caused by:

-

Accidental Re-Filing – Submitting the same W-2 multiple times electronically.

-

Incorrect Payroll Setup – Multiple employees with similar SSNs or payroll records.

-

Software Glitches – Occasionally, QuickBooks Desktop may not sync properly with payroll updates.

-

Manual Errors – Adding or modifying employee payroll details after initial filing without updating records.

Identifying the cause helps determine the best method to fix it.

Step 1: Verify the Duplicate W-2s

Before taking corrective action, confirm that a duplicate exists:

-

Open QuickBooks Desktop.

-

Go to Employees → Payroll Tax Forms & W-2s → Process Payroll Forms.

-

Select Annual Form W-2/W-3 – Wage and Tax Statement.

-

Compare the filed forms with your records.

Check for duplicate employee entries, amounts, or filing dates. This will ensure you’re addressing actual duplicates and not phantom errors.

Step 2: Contact the Payroll Service

If your W-2s were filed electronically using QuickBooks Desktop Payroll, contacting payroll support is essential:

-

QuickBooks Desktop Assisted Payroll users can request a voided W-2 or a correction filing.

-

They will help submit a corrected W-2 or W-3 form to the IRS and SSA.

For QuickBooks Desktop users, phone support or live chat is often the fastest way to resolve duplicate filings.

Step 3: Create a Corrected W-2 in QuickBooks Desktop

If you need to fix a duplicate W-2 yourself:

-

Go to Employees → Payroll Tax Forms & W-2s → Process Payroll Forms.

-

Select the W-2 for the employee needing correction.

-

Click Create Form or Correct W-2.

-

Follow the on-screen prompts to adjust wages, taxes, or filing information.

-

Submit the corrected W-2 electronically or print and mail if required.

Tip: QuickBooks Desktop will automatically adjust the W-3 summary totals if you correct individual W-2s.

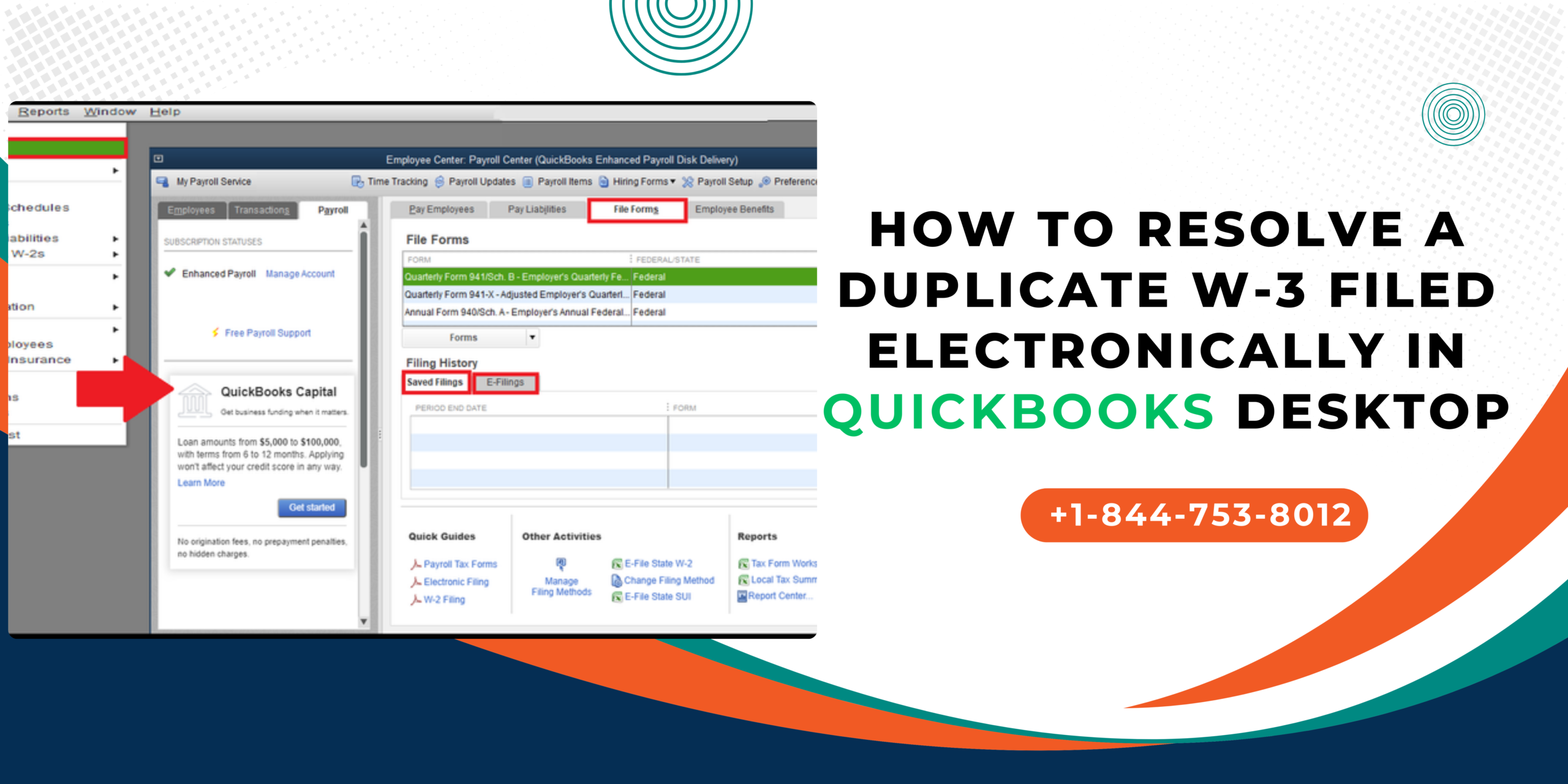

Step 4: File a Corrected W-3 (If Necessary)

If the duplicate affected the W-3 summary form:

- Go to Employees → Payroll Tax Forms & W-2s → Process Payroll Forms → W-3.

- Select Corrected W-3.

- Verify that totals now match the corrected W-2s.

- Submit electronically or via paper filing, depending on your payroll service.

Correcting the W-3 ensures the IRS has accurate totals for all wages and taxes.

Step 5: Prevent Future Duplicates

To avoid filing duplicate W-2s in the future:

- Reconcile Payroll Records Before Filing – Double-check employee SSNs, wages, and tax withholdings.

- Update Payroll After Changes – Make adjustments before W-2 generation.

- Track Filings – Maintain a log of electronically filed forms.

- Use Payroll Reports – Run Payroll Summary and Employee Detail reports to ensure accuracy.

Preventive steps minimize errors and reduce IRS correspondence.

Final Thoughts

Duplicate W-2 filings in QuickBooks Desktop can be stressful, but they are fixable. The key steps are:

- Verify duplicates exist.

- Contact your payroll service if needed.

- Correct individual W-2 forms.

- File corrected W-3 summaries if necessary.

- Implement preventive measures for future filings.

Following this workflow ensures compliance with the IRS and SSA, protects your employees, and keeps your payroll records accurate.

For professional help fixing duplicate W-2 forms in QuickBooks Desktop, call 844-753-8012 for step-by-step support.